1. Focus has shifted from supply side to demand – Whilst OPEC cuts and sanctions on Venezuela and Iran drove oil prices higher earlier in the year, more recently the demand side of the equation is dominating. As concerns over a global downturn increase, fears over a drop in global demand for oil are growing. The US Energy Information Association (EIA) cutting its forecast for 2019 world oil demand feed into this narrative sending the price of oil lower.

2. US – Sino trade dispute - with the ongoing trade dispute between the US and China, the words largest consumers of oil, showing no signs of a resolution. The impact of increased trade tensions on the two economies is becoming more evident, as economic data continues to surprise to the downside.

3. Rising stockpiles – An unexpected rise in US stockpiles is keeping oil under pressure. US crude inventories for week ending 7th June, increased by 4.9 million barrels vs. expectations of a 481,000 barrel decrease, data showed on Tuesday. Investors are growing increasingly concerned over swelling stockpiles amid slowing a slowing outlook for demand.

4. OPEC to continue output cuts? OPEC plus Russia have limited their production output since the start of the year, to support falling prices. Traders will turn their attention to the next OPEC meeting expected 25th June where they will discuss the continuation of the current cuts. Given volatile output from Iran and the increasingly uncertain economic outlook, the broad expectation is that OPEC will agree to keep the cuts in place. This would be supportive of oil prices potentially giving them a lift in the third quarter.

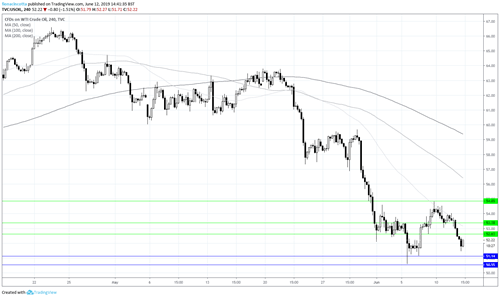

WTI Levels to watch:

Oil is down for the third straight session, trading below its 50, 100 and 200 sma. A clear bearish trend. Immediate support can be seen at $51.15, before $51.50 and the key $50 level. On the upside a break through $52.60 could open the door to $53.40.